- Load the R packages we will use.

- Read the data in the file ‘drug_cos.csv’ in to R and assign it to ‘drug_cos’.

drug_cos <- read_csv("https://estanny.com/static/week5/drug_cos.csv")

- Use ‘glimpse’ to get a glimpse of your data.

glimpse(drug_cos)

Rows: 104

Columns: 9

$ ticker <chr> "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "Z...

$ name <chr> "Zoetis Inc", "Zoetis Inc", "Zoetis Inc", "Z...

$ location <chr> "New Jersey; U.S.A", "New Jersey; U.S.A", "N...

$ ebitdamargin <dbl> 0.149, 0.217, 0.222, 0.238, 0.182, 0.335, 0....

$ grossmargin <dbl> 0.610, 0.640, 0.634, 0.641, 0.635, 0.659, 0....

$ netmargin <dbl> 0.058, 0.101, 0.111, 0.122, 0.071, 0.168, 0....

$ ros <dbl> 0.101, 0.171, 0.176, 0.195, 0.140, 0.286, 0....

$ roe <dbl> 0.069, 0.113, 0.612, 0.465, 0.285, 0.587, 0....

$ year <dbl> 2011, 2012, 2013, 2014, 2015, 2016, 2017, 20...- Use ‘distinct’ to subset distinct rows.

drug_cos %>%

distinct(year)

# A tibble: 8 x 1

year

<dbl>

1 2011

2 2012

3 2013

4 2014

5 2015

6 2016

7 2017

8 2018- Use ‘count’ to count observations by group.

drug_cos %>%

distinct(year)

# A tibble: 8 x 1

year

<dbl>

1 2011

2 2012

3 2013

4 2014

5 2015

6 2016

7 2017

8 2018drug_cos %>%

count(name)

# A tibble: 13 x 2

name n

* <chr> <int>

1 AbbVie Inc 8

2 Allergan plc 8

3 Amgen Inc 8

4 Biogen Inc 8

5 Bristol Myers Squibb Co 8

6 ELI LILLY & Co 8

7 Gilead Sciences Inc 8

8 Johnson & Johnson 8

9 Merck & Co Inc 8

10 Mylan NV 8

11 PERRIGO Co plc 8

12 Pfizer Inc 8

13 Zoetis Inc 8drug_cos %>%

count(ticker, name)

# A tibble: 13 x 3

ticker name n

<chr> <chr> <int>

1 ABBV AbbVie Inc 8

2 AGN Allergan plc 8

3 AMGN Amgen Inc 8

4 BIIB Biogen Inc 8

5 BMY Bristol Myers Squibb Co 8

6 GILD Gilead Sciences Inc 8

7 JNJ Johnson & Johnson 8

8 LLY ELI LILLY & Co 8

9 MRK Merck & Co Inc 8

10 MYL Mylan NV 8

11 PFE Pfizer Inc 8

12 PRGO PERRIGO Co plc 8

13 ZTS Zoetis Inc 8- Use’ filter to extract rows in non- consecutive years.

# A tibble: 26 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

2 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

3 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

4 PRGO PERR~ Ireland 0.178 0.387 0.028 0.088

5 PFE Pfiz~ New Yor~ 0.447 0.82 0.267 0.307

6 PFE Pfiz~ New Yor~ 0.34 0.79 0.208 0.221

7 MYL Myla~ United ~ 0.244 0.428 0.094 0.163

8 MYL Myla~ United ~ 0.258 0.35 0.031 0.074

9 MRK Merc~ New Jer~ 0.33 0.652 0.13 0.182

10 MRK Merc~ New Jer~ 0.313 0.681 0.147 0.206

# ... with 16 more rows, and 2 more variables: roe <dbl>, year <dbl>- Extract every other year from 2012 to 2018

# A tibble: 52 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

2 ZTS Zoet~ New Jer~ 0.238 0.641 0.122 0.195

3 ZTS Zoet~ New Jer~ 0.335 0.659 0.168 0.286

4 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

5 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

6 PRGO PERR~ Ireland 0.157 0.371 0.059 0.104

7 PRGO PERR~ Ireland -0.791 0.389 -0.76 -0.877

8 PRGO PERR~ Ireland 0.178 0.387 0.028 0.088

9 PFE Pfiz~ New Yor~ 0.447 0.82 0.267 0.307

10 PFE Pfiz~ New Yor~ 0.359 0.807 0.184 0.247

# ... with 42 more rows, and 2 more variables: roe <dbl>, year <dbl>- Extract the tickers “MYL”, “LLY”, and “JNL”

# A tibble: 16 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 MYL Myla~ United ~ 0.245 0.418 0.088 0.161

2 MYL Myla~ United ~ 0.244 0.428 0.094 0.163

3 MYL Myla~ United ~ 0.228 0.44 0.09 0.153

4 MYL Myla~ United ~ 0.242 0.457 0.12 0.169

5 MYL Myla~ United ~ 0.243 0.447 0.09 0.133

6 MYL Myla~ United ~ 0.19 0.424 0.043 0.052

7 MYL Myla~ United ~ 0.272 0.402 0.058 0.121

8 MYL Myla~ United ~ 0.258 0.35 0.031 0.074

9 LLY ELI ~ Indiana~ 0.277 0.791 0.179 0.22

10 LLY ELI ~ Indiana~ 0.304 0.788 0.181 0.239

11 LLY ELI ~ Indiana~ 0.317 0.788 0.203 0.255

12 LLY ELI ~ Indiana~ 0.223 0.749 0.122 0.153

13 LLY ELI ~ Indiana~ 0.211 0.748 0.121 0.14

14 LLY ELI ~ Indiana~ 0.23 0.731 0.129 0.159

15 LLY ELI ~ Indiana~ 0.165 0.731 -0.009 0.096

16 LLY ELI ~ Indiana~ 0.22 0.738 0.132 0.155

# ... with 2 more variables: roe <dbl>, year <dbl>- Select columns ‘ticker’, ‘name’ and ‘grossmargin’

drug_cos %>%

select(ticker, name, grossmargin)

# A tibble: 104 x 3

ticker name grossmargin

<chr> <chr> <dbl>

1 ZTS Zoetis Inc 0.61

2 ZTS Zoetis Inc 0.64

3 ZTS Zoetis Inc 0.634

4 ZTS Zoetis Inc 0.641

5 ZTS Zoetis Inc 0.635

6 ZTS Zoetis Inc 0.659

7 ZTS Zoetis Inc 0.666

8 ZTS Zoetis Inc 0.672

9 PRGO PERRIGO Co plc 0.343

10 PRGO PERRIGO Co plc 0.345

# ... with 94 more rows- Use ‘select to exclude columns ’ticker’, ‘name’, and ‘grossmargin’

drug_cos %>%

select(-ticker,-name, -grossmargin)

# A tibble: 104 x 6

location ebitdamargin netmargin ros roe year

<chr> <dbl> <dbl> <dbl> <dbl> <dbl>

1 New Jersey; U.S.A 0.149 0.058 0.101 0.069 2011

2 New Jersey; U.S.A 0.217 0.101 0.171 0.113 2012

3 New Jersey; U.S.A 0.222 0.111 0.176 0.612 2013

4 New Jersey; U.S.A 0.238 0.122 0.195 0.465 2014

5 New Jersey; U.S.A 0.182 0.071 0.14 0.285 2015

6 New Jersey; U.S.A 0.335 0.168 0.286 0.587 2016

7 New Jersey; U.S.A 0.366 0.163 0.321 0.488 2017

8 New Jersey; U.S.A 0.379 0.245 0.326 0.694 2018

9 Ireland 0.216 0.123 0.178 0.248 2011

10 Ireland 0.226 0.127 0.183 0.236 2012

# ... with 94 more rows- Rename and reorder columns with ‘select’.

Start with ‘drug_cos’. THEN

change the name of ‘location’ to ‘headquarter’

put the columns in this order:‘year’, ‘ticker’, headquarter’, ‘netmargin’,‘roe’

drug_cos %>%

select(year, ticker, headquarter =location, netmargin, roe)

# A tibble: 104 x 5

year ticker headquarter netmargin roe

<dbl> <chr> <chr> <dbl> <dbl>

1 2011 ZTS New Jersey; U.S.A 0.058 0.069

2 2012 ZTS New Jersey; U.S.A 0.101 0.113

3 2013 ZTS New Jersey; U.S.A 0.111 0.612

4 2014 ZTS New Jersey; U.S.A 0.122 0.465

5 2015 ZTS New Jersey; U.S.A 0.071 0.285

6 2016 ZTS New Jersey; U.S.A 0.168 0.587

7 2017 ZTS New Jersey; U.S.A 0.163 0.488

8 2018 ZTS New Jersey; U.S.A 0.245 0.694

9 2011 PRGO Ireland 0.123 0.248

10 2012 PRGO Ireland 0.127 0.236

# ... with 94 more rowsQuestion: Filter and Select

start with ‘drug_cos’ THEN

extract information from MYL, LLY, and JNJ. THEN

select the variables ‘ticker’, ‘year’, and ‘grossmargin’.

# A tibble: 24 x 3

ticker year grossmargin

<chr> <dbl> <dbl>

1 MYL 2011 0.418

2 MYL 2012 0.428

3 MYL 2013 0.44

4 MYL 2014 0.457

5 MYL 2015 0.447

6 MYL 2016 0.424

7 MYL 2017 0.402

8 MYL 2018 0.35

9 LLY 2011 0.791

10 LLY 2012 0.788

# ... with 14 more rowsQuestion: Rename

-start with ‘drug_cos’. THEN

-extract information for the tickers PFV, and BMY

-select the variables ‘ticker’, ‘ebitdamargin’, and ‘roe’. THEN

-Change the name of ‘roe’ to ‘return_on_equity’.

drug_cos %>%

filter(ticker %in% c("PFV", "BMY")) %>%

select(ticker, ebitdamargin, return_on_equity_ =roe)

# A tibble: 8 x 3

ticker ebitdamargin return_on_equity_

<chr> <dbl> <dbl>

1 BMY 0.285 0.229

2 BMY 0.141 0.131

3 BMY 0.222 0.177

4 BMY 0.178 0.132

5 BMY 0.144 0.104

6 BMY 0.322 0.292

7 BMY 0.286 0.072

8 BMY 0.292 0.373- Select ranges of columns

by name

drug_cos %>%

select(ebitdamargin:netmargin)

# A tibble: 104 x 3

ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl>

1 0.149 0.61 0.058

2 0.217 0.64 0.101

3 0.222 0.634 0.111

4 0.238 0.641 0.122

5 0.182 0.635 0.071

6 0.335 0.659 0.168

7 0.366 0.666 0.163

8 0.379 0.672 0.245

9 0.216 0.343 0.123

10 0.226 0.345 0.127

# ... with 94 more rowsby position

drug_cos %>%

select(4:6)

# A tibble: 104 x 3

ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl>

1 0.149 0.61 0.058

2 0.217 0.64 0.101

3 0.222 0.634 0.111

4 0.238 0.641 0.122

5 0.182 0.635 0.071

6 0.335 0.659 0.168

7 0.366 0.666 0.163

8 0.379 0.672 0.245

9 0.216 0.343 0.123

10 0.226 0.345 0.127

# ... with 94 more rows13.’select’ helper functions

‘starts_with(“abc”)’ matches columns start with “abc”

‘ends_with(“abc”)’ matches columns ending with “abc”

‘contains(“abc”)’ matches columns containing “abc”

drug_cos %>%

select(ticker, contains("locat"))

# A tibble: 104 x 2

ticker location

<chr> <chr>

1 ZTS New Jersey; U.S.A

2 ZTS New Jersey; U.S.A

3 ZTS New Jersey; U.S.A

4 ZTS New Jersey; U.S.A

5 ZTS New Jersey; U.S.A

6 ZTS New Jersey; U.S.A

7 ZTS New Jersey; U.S.A

8 ZTS New Jersey; U.S.A

9 PRGO Ireland

10 PRGO Ireland

# ... with 94 more rowsdrug_cos %>%

select(ticker, starts_with("r"))

# A tibble: 104 x 3

ticker ros roe

<chr> <dbl> <dbl>

1 ZTS 0.101 0.069

2 ZTS 0.171 0.113

3 ZTS 0.176 0.612

4 ZTS 0.195 0.465

5 ZTS 0.14 0.285

6 ZTS 0.286 0.587

7 ZTS 0.321 0.488

8 ZTS 0.326 0.694

9 PRGO 0.178 0.248

10 PRGO 0.183 0.236

# ... with 94 more rowsdrug_cos %>%

select(ticker, ends_with("margin"))

# A tibble: 104 x 4

ticker ebitdamargin grossmargin netmargin

<chr> <dbl> <dbl> <dbl>

1 ZTS 0.149 0.61 0.058

2 ZTS 0.217 0.64 0.101

3 ZTS 0.222 0.634 0.111

4 ZTS 0.238 0.641 0.122

5 ZTS 0.182 0.635 0.071

6 ZTS 0.335 0.659 0.168

7 ZTS 0.366 0.666 0.163

8 ZTS 0.379 0.672 0.245

9 PRGO 0.216 0.343 0.123

10 PRGO 0.226 0.345 0.127

# ... with 94 more rows- ‘group_by’

drug_cos %>%

group_by(ticker)

# A tibble: 104 x 9

# Groups: ticker [13]

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.149 0.61 0.058 0.101

2 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

3 ZTS Zoet~ New Jer~ 0.222 0.634 0.111 0.176

4 ZTS Zoet~ New Jer~ 0.238 0.641 0.122 0.195

5 ZTS Zoet~ New Jer~ 0.182 0.635 0.071 0.14

6 ZTS Zoet~ New Jer~ 0.335 0.659 0.168 0.286

7 ZTS Zoet~ New Jer~ 0.366 0.666 0.163 0.321

8 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

9 PRGO PERR~ Ireland 0.216 0.343 0.123 0.178

10 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

# ... with 94 more rows, and 2 more variables: roe <dbl>, year <dbl>drug_cos %>%

group_by(year)

# A tibble: 104 x 9

# Groups: year [8]

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.149 0.61 0.058 0.101

2 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

3 ZTS Zoet~ New Jer~ 0.222 0.634 0.111 0.176

4 ZTS Zoet~ New Jer~ 0.238 0.641 0.122 0.195

5 ZTS Zoet~ New Jer~ 0.182 0.635 0.071 0.14

6 ZTS Zoet~ New Jer~ 0.335 0.659 0.168 0.286

7 ZTS Zoet~ New Jer~ 0.366 0.666 0.163 0.321

8 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

9 PRGO PERR~ Ireland 0.216 0.343 0.123 0.178

10 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

# ... with 94 more rows, and 2 more variables: roe <dbl>, year <dbl>- Maximum ‘roe’ for all companies

drug_cos %>%

summarize(max_roe = max(roe))

# A tibble: 1 x 1

max_roe

<dbl>

1 1.31maximum ‘roe for each ’year’

drug_cos %>%

group_by(year) %>%

summarize(max_roe = max(roe))

# A tibble: 8 x 2

year max_roe

* <dbl> <dbl>

1 2011 0.451

2 2012 0.69

3 2013 1.13

4 2014 0.828

5 2015 1.31

6 2016 1.11

7 2017 0.932

8 2018 0.694maximum ‘roe; for each ’ticker’

# A tibble: 1 x 2

year max_roe

<dbl> <dbl>

1 2011 0.451Question: Summarize

The mean ‘ebitdamargin’ is 0.297 or 29.7%

drug_cos %>%

group_by(year) %>%

summarize(mean_ebitdamargin = mean(ebitdamargin)) %>%

filter(year == 2011)

# A tibble: 1 x 2

year mean_ebitdamargin

<dbl> <dbl>

1 2011 0.297The median ’ebitdamargin for 2011 is 0.282 or 28.2%

drug_cos %>%

group_by(year) %>%

summarize(median_ebitdamargin = median(ebitdamargin)) %>%

filter(year == 2011)

# A tibble: 1 x 2

year median_ebitdamargin

<dbl> <dbl>

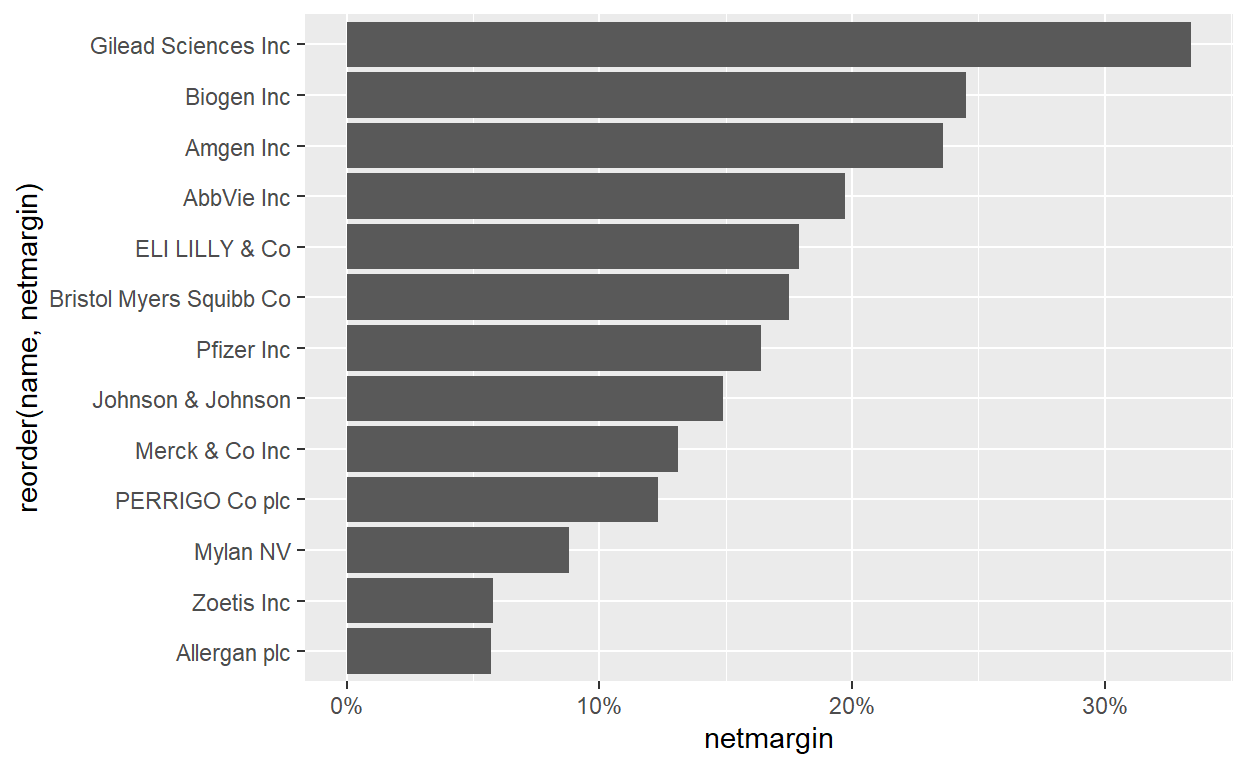

1 2011 0.282- Pick a ratio and a year and compare the companies.

drug_cos %>%

filter(year == 2011) %>%

ggplot(aes(x = netmargin, y = reorder(name, netmargin))) +

geom_col() +

scale_x_continuous(labels = scales::percent)

labs(title = "comparison of net margin",

subtitle = "for drug companies during 2018",

x = NULL, y = NULL) +

theme_classic()

NULL ggsave(filename = "preview.png",

path = here::here("_posts", "2021-03-08-data-manipulation"))